The madness of markets

As an investor, it is generally not a bad idea to ignore what is going on in your portfolio most of the time. At the very least it can be distracting and at worst it can be a source of unnecessary anxiety. That advice is as applicable today as it ever was.

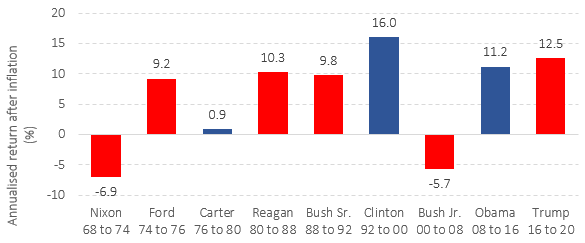

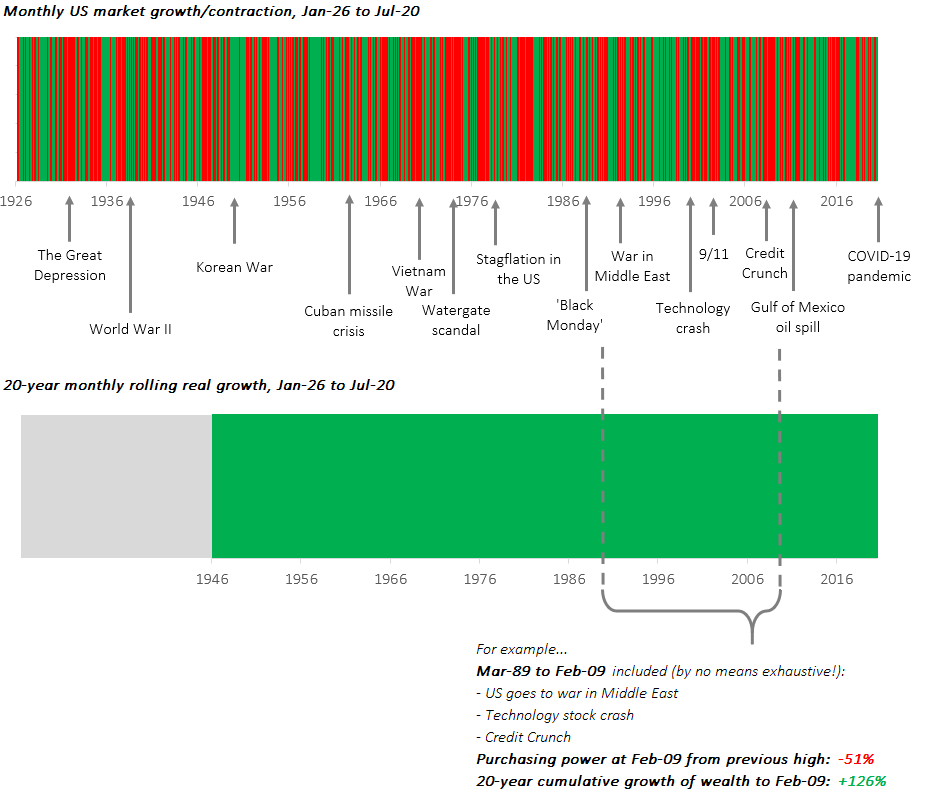

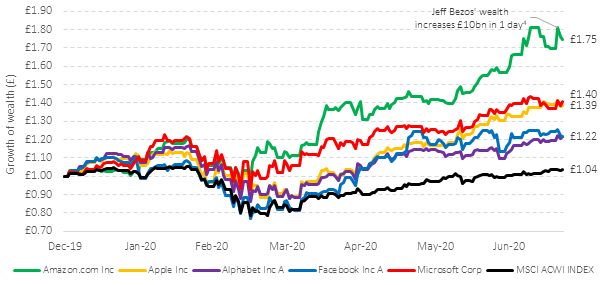

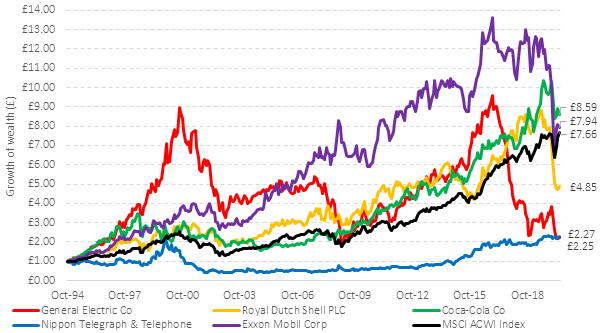

The markets feel like they have gone a bit mad! Since the start of the pandemic – and despite a 25% or so fall in late February and early March – global markets (developed and emerging combined) have gone up by more than 10%[1]. Some sectors and companies have delivered far higher returns. For example, the ‘FAANGs’ (Facebook, Apple, Amazon, Netflix, and Google) – all beneficiaries of global lockdowns – have risen collectively by 45% since the pre-pandemic market high[2]. In May 2020, Elon Musk, Telsa’s CEO, tweeted that its share price was too high, and it fell 10% overnight to US$80, yet Tesla’s share price has, since then, grown almost ten-fold to $804 on 10th February 2021. Today Tesla’s market capitalisation is now larger than the next nine global car manufacturers combined, including Honda, VW, Renault-Nissan, and GM[3]. Let’s not even mention Bitcoin! Are these fair prices or are they overvalued?

The rational investor would say that the market is simply looking beyond the pandemic and to a time of global recovery and a more normal world and that the market is the best judge of prices. Yet some investors may have concern that markets are in a bubble and question if they should reduce their equity holdings. Others may see the extraordinary returns from a certain sectors and companies and feel a sense of FOMO (fear of missing out) that they are not more heavily invested in tech stocks or Tesla, for example. The problem is that the markets may be right…or wrong. The one thing we know for sure is that it is impossible to know which with any certainty, and the evidence tells us that even professionals have little ability to time entry into or out of stocks, sectors, or markets successfully. Markets can remain seemingly mad for a long time. As John Maynard Keynes famously once said:

“Markets can remain irrational longer than you can remain solvent.”

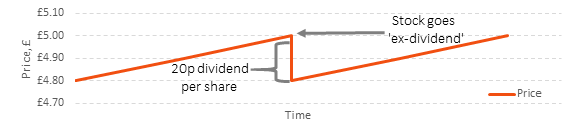

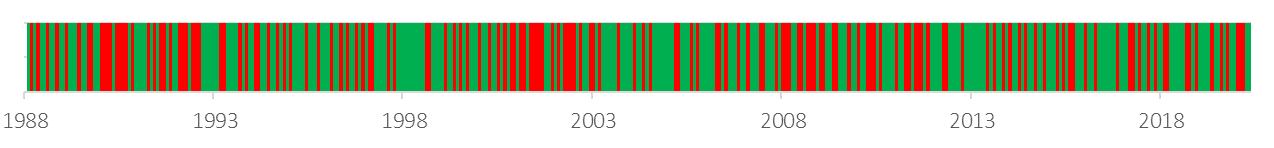

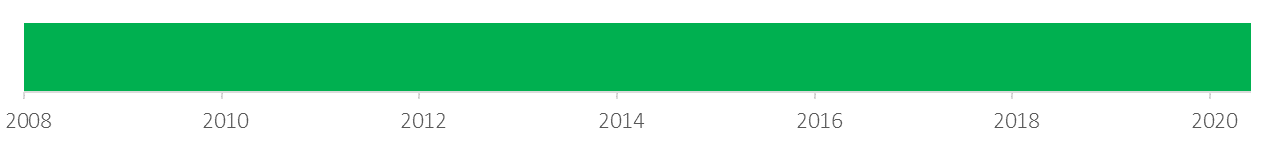

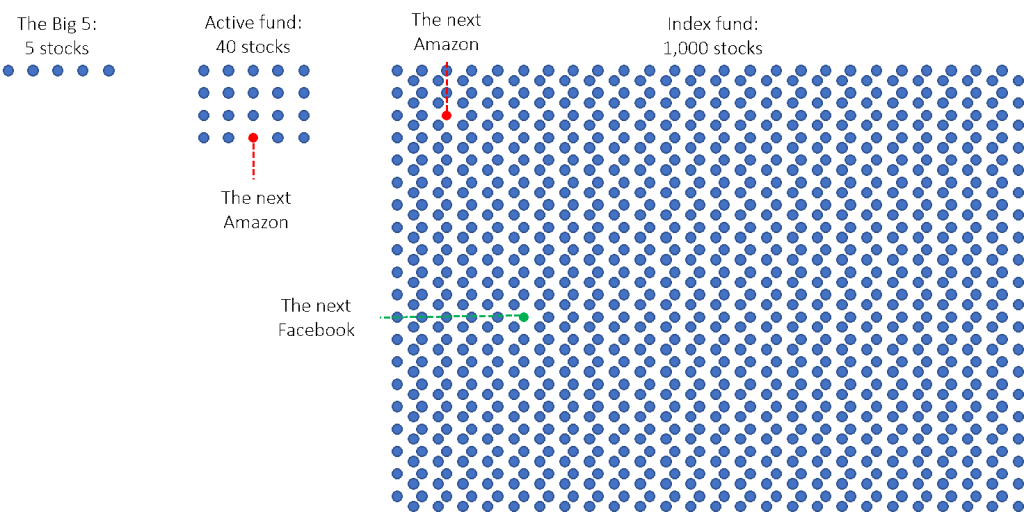

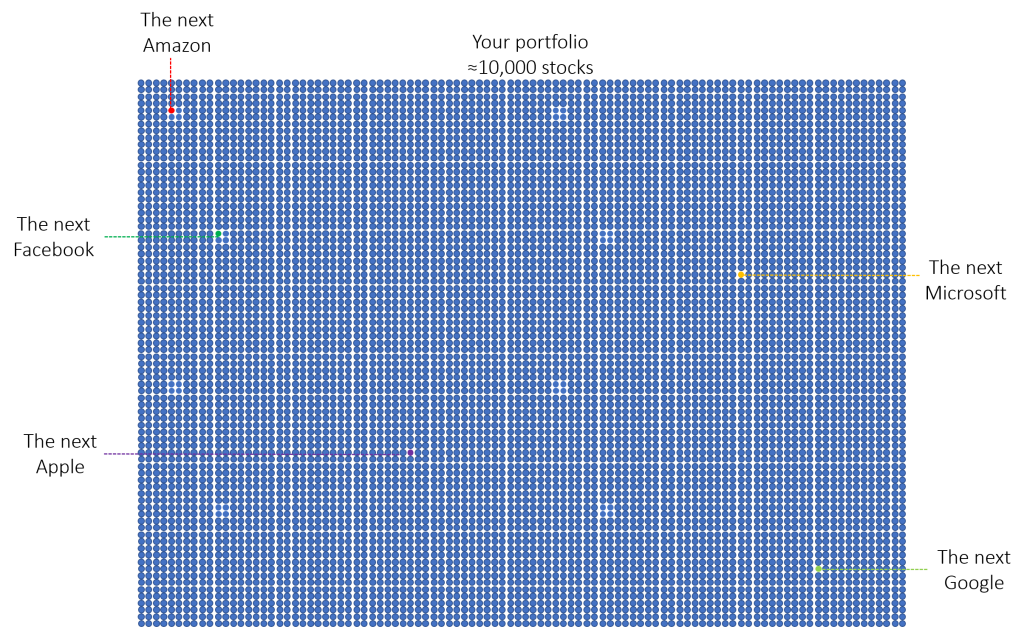

Sensible investing is about remaining highly diversified across markets, sectors, and companies to avoid absolute losses and to try to smooth out returns as much as possible over time. To many that is a great comfort and allows them to sleep at night. Rebalancing periodically and reminding yourself that you do not need to cash in your equity assets in the near term is worthwhile. It may not be as exciting as punting (which is what it is) on Tesla or Bitcoin, but it will reap its rewards over time. Remember too that by being diversified means that you will benefit from being in the companies and sectors that do well. In 2020, the developed global stock markets returned around 12% in GBP terms. Of this 12%, half – or an absolute 6% – of this return was attributed to the top 10 stocks. The FAANGs alone represented 30% (i.e. around 4% of the 12%)[4]. That is surely enough exposure for most. Stick with the plan and try not to look at, or think about, your portfolio too much. Attempting to second guess the market is a fool’s errand.

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Use of Morningstar Direct© data

© Morningstar 2020. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied, adapted or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information, except where such damages or losses cannot be limited or excluded by law in your jurisdiction. Past financial performance is no guarantee of future results.

[1] MSCI ACWI Index in GBP terms from 19/02/2020 to 10/02/2021

[2] https://uk.tradingview.com/chart/?symbol=FX%3AFAANG in USD

[4] GSI (2021), The recent performance of Growth and Value.

Recent Comments