This week HMRC will start contacting self-employed people who are likely to be eligible, through a combination of emails, SMS texts and letters, to tell them what they need to do to get ready to claim. Applications will open in tranches based on the unique taxpayer number (UTR) given to all self-employed taxpayers.

From this week, people will be able to use a new online eligibility checker. If the checker confirms that they are eligible (and they qualify due to being affected by coronavirus and because they intend to continue trading), they will be given a date when they can use the online service to make a claim from 13 May.

Payments will be made to claimants’ bank accounts from 25 May 2020 (ahead of the original June schedule)

Self Employed Income Support Scheme Eligibility checker see: https://www.tax.service.gov.uk/self-employment-support/enter-unique-taxpayer-reference

HMRC have issued some more details relating to the claims for the Self-Employed Income Support. The latest guidance was issued on 1 May.

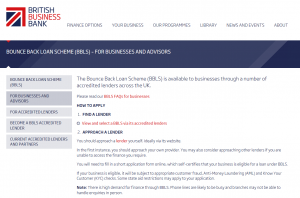

Details are in the link highlighted below.

As with many HMRC “guidance notes” issued recently, these tend to be quite basic, and, unfortunately, leave many questions unanswered.

It is hoped that HMRC may rethink the method of claim, but at this moment, the latest guidance clearly states: “Your tax agent cannot make the claim for you”, meaning we cannot apply on your behalf.

The guidance goes on to indicate that you will require: –

- Your Self-assessment Unique Taxpayer Reference Number

- Your National Insurance Number

- Your Government Gateway ID and Password

- Bank account number and sort code for payment

Contact us if you are unable to locate 1 or 2 above. However, the biggest issue is likely to be item 3.

IF YOU KNOW YOUR GOVERNMENT GATEWAY ID AND PASSWORD YOU DO NOT NEED TO TAKE ANY ACTION AT THIS TIME.

IF YOU DO NOT KNOW OR DON’T HAVE A GOVERNMENT GATEWAY ID AND PASSWORD WE RECOMMEND YOU APPLY AS SOON AS POSSIBLE TO AVOID DELAYS IN RECEIVING PAYMENT. YOU MAY BE ABLE TO SUBMIT A PAPER CLAIM (FULL DETAILS NOT YET PUBLISHED) BUT THIS WILL ALSO LEAD TO DELAYS IN PAYMENT.

Details on the application process are set out below. This will take a few days before it is ready.

If you need any assistance please contact us as soon as possible.

Recent Comments