We associate the term ‘bond’ with mutual connection, whether the subject is chemistry (between atoms, ions, or molecules), personal relationships (between human beings), or finance (between borrowers and lenders). The latter is often thought to be difficult to understand and shrouded in complex mathematics. Actually, bonds can be quite a straightforward concept.

In their simplest sense, bonds are IOUs set up between borrowers and lenders. At the outset, the borrower will determine how much and for how long they would like to borrow, and what they are willing to pay the lender – typically once or twice per year – as appropriate compensation for borrowing their money.

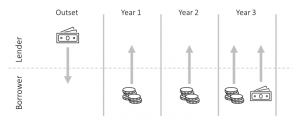

Bonds are also known as fixed income securities. The simple example of a bond setup below illustrates why bonds carry this other name. The future cash flows a lender receives are fixed and predictable. At the outset, a sum is lent. Each year, an amount is paid to the lender (the coupon) and at the end of the term the original sum is returned.

Figure 1: Simple illustration of a 3-year bond with an annual coupon

Borrowers, also known as bond issuers, are prominently composed of governments and companies around the world. A significant difference between bonds and more traditional loans is that bonds are marketable. In other words, the lender in the IOU agreement can sell the right to receive the cash flows to someone else. This is why the lender will more commonly be referred to as the bondholder.

The relationship between risk and return does not come unstuck for fixed income. If the borrower is a large, developed government it is highly likely that bondholders will be repaid and so the government can offer lower coupons. The USA, for example, has never defaulted on its national debt. By contrast, a company on the brink of financial collapse would have to offer much higher compensation to encourage lenders. This is the point where fixed income often becomes less ‘fixed’.

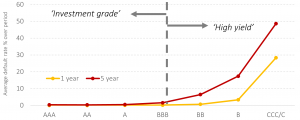

Analysing the ability for companies or governments to pay back lenders is a complex and comprehensive process for investors. Thankfully rating agencies do much of the heavy lifting. S&P, a rating agency, demonstrates[1] on average between 1981 and 2020 bonds with the lowest rating of CCC/C had a 28% chance of defaulting over the next 12-month period, whereas for those rated highest at AAA that chance was zero.

Figure 2: Cumulative average default rate % of global corporate bonds 1981-2020

Data source: S&P (2021). “Default, Transition, and Recovery: 2020 Annual Global Corporate Default and Rating Transition Study”. Rating refers to rating at outset of respective period.

The reader will notice that owners of investment grade bonds are considerably more likely to receive back the capital lent to the borrower compared with high yield bonds (formerly ‘junk’ bonds!). It is for this reason we allocate the fixed income element of your portfolio to these such bonds through the use of investment funds that diversify across many different highly rated bonds. We may often refer to this part of the portfolio as the ‘defensive assets’.

The key takeaways

- A bond is an IOU between a borrower, such as a government or company, and a lender. The ownership of this IOU can be traded between lenders (bondholders), and with it the right to receive the cash flows from the borrower.

- The main features of a bond are the maturity (i.e., term of the loan) and credit quality. The latter is determined by rating agencies and gives an insight into a borrower’s credit worthiness.

- Investment grade bonds provide more certainty of future payments to lenders compared with high yield bonds. A shorter lending term also generally corresponds to higher certainty of repayment. For this reason, when investing in bonds we typically allocate to shorter term, higher credit quality securities.

If you have any questions, thoughts or actions relating to the content of this article please get in touch with us by calling us on 028 9099 6948 or by emailing info@pacem-advisory.com

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

[1] S&P (2021). “Default, Transition, and Recovery: 2020 Annual Global Corporate Default and Rating Transition Study”

Recent Comments