Investing is all about tradeoffs. Each choice made is paired with an implicit decision not to do some alternative; the ‘opportunity cost’. For example, by investing solely in a basket of UK companies one accepts the risk of losing out if the UK market struggles relative to the rest of the world, and vice-versa. An investment portfolio could be constructed to reflect other preferences, such as the appetite to have exposure to certain companies or industries, adopt a specific level of equity or fixed income risk, or attempt to adjust the average fee paid to managers, to name a few. Choices come with consequences.

Recently, insight provided by Hargreaves Lansdown – the UK’s largest fund platform managing around £120bn[1] – and Interactive Investor – the UK’s largest flat-fee platform[2] – shed some light on the preferences of younger investors coming to market[3].

“The younger generation want things they are passionate about, that they can engage with, that resonate with their particular desires and preferences, whatever those may be. They want things they can be passionate about.”

The data suggest that younger investors have tended to invest in companies they feel strongly about, a standout theme being the electric car industry at present through firms such as Tesla and NIO. Gavin Corr, head of manager selection and due diligence services at Morningstar, went on to say:

“The younger generation will not be happy in a multi-asset balanced 60/40 portfolio, sitting alongside another million other investors that are profiled exactly the same way. This democratisation or mass customisation is coming”

Gavin Corr, Morningstar[4]

The challenge is that preferences naturally come with their own tradeoffs. This is crucial to remember. To avoid a traditional balanced portfolio and instead own a portfolio of ‘clean energy’ firms, perhaps with electric cars, wind turbines and solar energy as themes, one must accept that they own a highly concentrated portfolio of stocks with low levels of diversification, large sector biases and likely with high management costs. This is likely to negatively impact returns in the medium to longer term.

The aim of this short note is not to suggest that these preferences are wrong, in fact investors may benefit from an ‘emotional dividend’ to compensate investors and make the tradeoffs worthwhile[5]. This emotional dividend, however, is rewarded at the cost of actual investment returns and investors may not realise the magnitude of this cost.

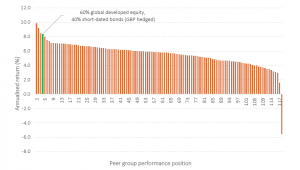

A key pillar of our investment philosophy is to accept that capital markets do a good job of pricing securities and therefore markets are difficult to beat. The table below demonstrates this belief by comparing a simple two-fund developed equity and bond portfolio[6] against the cohort of managers running ‘balanced’ portfolios Corr (2021) referred to. Each of the other managers in the figure will have had their own preferences, which evidently come with consequences.

Figure 1: Multi-asset peer group performance – 10 years to Jul-21

Morningstar Direct © All rights reserved. Morningstar category: EAA Fund GBP Moderate Allocation.

The tradeoffs are well demonstrated in the chart above. A traditional 60/40 portfolio holds up exceptionally well. Only 3 of the 116 funds in the sample provided a superior return to the 60/40 ‘balanced’ portfolio, that is without accounting for any funds that may have closed in the last 10-years! Investors who wish to express their preferences in portfolios should be aware they are at a high risk of market underperformance. Sticking to sound, well researched investment principles is key to a successful outcome.

[1] Money to the Masses (2021) https://moneytothemasses.com/saving-for-your-future/…

[2] FT Adviser (2020) https://www.ftadviser.com/investments/…

[3] Citywire (2021) Everything you need to know about young investors. https://citywire.co.uk/…

[4] Citywire (2021) Morningstar: Impersonal 60/40 portfolio won’t impress young clients. https://citywire.co.uk/…

[5] Rational Reminder Podcast (2021) Episode 156: Climate Change vs. The Stock Market.

[6] Portfolio: 60% Vanguard Global Stock Index, 40% Dimensional Global Short-dated Bond. Rebalanced annually.

Recent Comments