Sensible investing is about taking on sensible risks in your portfolio, which starts with owning equities over cash. Historical data and logic tell us to expect a premium for doing so. In the long run this has been in the region of 3% to 4% per annum. It may not sound much, but when compounded over time it has an amazing beneficial impact on the level of wealth accumulated, and therefore life choices that can be made. Let’s generously assume that cash delivers 1% p.a. above inflation and equities deliver 5% p.a. above inflation. A sixty-year-old, perhaps approaching retirement, should be planning to live 100 these days. Investing in cash they would turn £1,000 of purchasing power into £1,500, whereas if they had invested in equities, £1,000 would be worth a little over £7,000. That provides materially greater choices and fewer worries about money.

The challenge that all investors face is that to capture these returns, owners of equities (part shares in real companies) is that they are likely to experience some tough times in the markets. The average 20-year global equity exposure (since 1955) turned £100 of purchasing power into around £250[1]. Although one unfortunate cohort of equity investors saw £100 turned into £85 over 20 years. In fact, on any one day you have something like a 1-in-2 chance that the equity risk premium will be negative, but over 5 years this falls to 1-in-8, and to around 1-in-10 at 10 years. The longer the period of time invested for, the greater the likelihood – but never the guarantee – that returns will be positive.

Investors could capture the returns of global equities using a cheap single index-tacking fund that captures the returns from global markets. It is certainly not a bad place to start, a view supported by Eugene Fama, renowned for his work on efficient markets for which he earned himself a Nobel Prize in Economics:

‘You’ve got to talk your way out of a market cap weighted portfolio’

There are some conversations – led by Fama himself – that suggest that owning overweights – or tilts – to specific parts of the market that have higher risks and thus higher expected returns may be one occasion to step away from markets, for those who have a preference to do so. These incremental returns, as we have seen above, are valuable to investors.

One such ‘risk factor’ is the ‘value’ premium, which is incorporated into portfolios. Accepting that markets work pretty well, incorporating information into prices efficiently (again another useful assumption to make), their prices must hold some useful information. Comparing equities to each other, scaled by either a balance sheet or profit and loss item, such as book value or earnings, allows us to rank them into ‘cheaper’ or ‘value’ stocks (e.g. low price relative to book value) and ‘expensive’ or ‘growth’ stocks (being the opposite). Given that the price is right (markets work) value stocks are not cheap in the ‘it’s a bargain’ way, but cheap because something else is going on. That something else is higher risk. However, the flip side of higher risk is higher return, which is evidenced in the historical data. It works across different time periods, markets and even asset classes. Different measures (e.g. price-to-cashflow, price-to-earnings, price-to-dividends) all work as robust measures of value. It has also been shown that the value premium can be extracted successfully in real, live funds.

Like the equity premium, extended periods of time can occur when the value premium is negative. Over the ten or so years to the end of 2020, owning value stocks was a tough place to be in a relative sense as growth stocks that became more and more ‘expensive’, despite delivering strong absolute returns. Some investors may have abandoned their value stocks, as they could not take the relative pain. As they sell them and go underweight value stocks, someone else has to be persuaded to buy them and hold the overweight position, improving the latter’s expected returns (remember it’s a zero-sum world out there). You get paid for holding stocks that kick you when you are down! However, if you hold a robust premium that meets stringent hurdles – as value does – the key is to hold not fold.

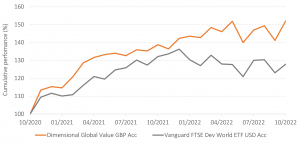

Take a look at what has been going on lately. Value stocks have been clawing back some of their relative underperformance to the broad market, delivering strong returns in markets where growth (‘expensive’) stocks have fallen hard in 2021-2, dragging down the broad market, not least in the US. This strong positive premium has been as seen in emerging markets too.

Figure 1: Global value has been delivering a positive premium of late

Data: Dimensional Global Value Fund Acc. in GBP and Vanguard FTSE Developed World UCITS ETF (VEVE)[2].

Steeping away from the market takes courage and discipline but is likely to be worth the wait. One swallow does not make a summer, but positive outcomes are always welcome.

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

[1] Albion Strategic Consulting (2021) – internal analysis.

[2] Note that these two funds have been used purely for educational purposes and reference to them should not be construed as any form of recommendation.