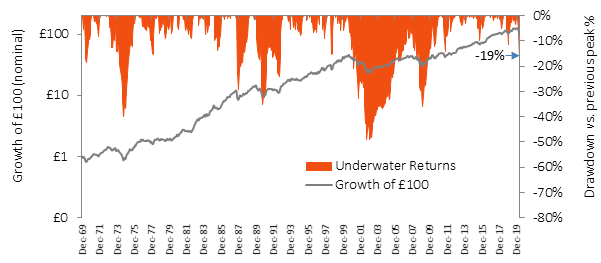

Humans have a hard time being investors. Normally, we like to purchase things when they are cheap and avoid them when they are expensive, but that is often not the case for equities. We tend to get overly optimistic and enthusiastic when equity markets rise dramatically, as they have done since the Global Financial Crisis a decade ago. Yet when markets fall materially, we feel bruised and cautious, seeking to hang onto our stable bonds and even selling equities to avoid further falls in portfolio value. That’s rarely a good idea, especially if you do not need the bulk of your capital in the foreseeable future.

As a client you will know that we have always sought to rebalance your portfolio on a regular basis, by which we mean returning it to the original target allocation that we initially established with you. Most often, over the past few years, rebalancing has meant selling growth assets (equity-like) and buying defensive assets (bonds) in a contrarian manner. This has helped to avoid the portfolio becoming dominated, over time, by the riskier growth assets component of the portfolio and to keep you within your emotional tolerance for falls, your financial capacity to weather them and your need to take risk in the first place.

Logically, the reverse also applies; at times like these the proportion of equities in your portfolio will have fallen below their long-term target. This matters because your portfolio now has too little risk and it will be harder for the growth assets remaining to recoup the falls in value when markets eventually recover.

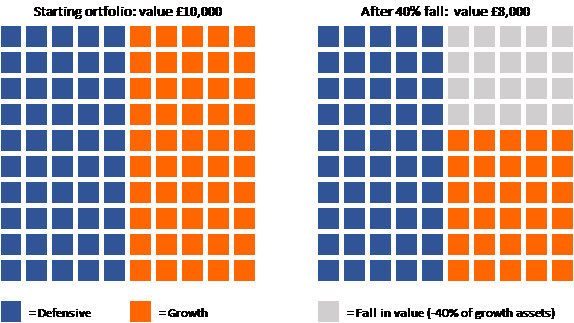

We can work that idea through with a simple example. Imagine you own a £10,000 portfolio split 50% (£5,000) into growth assets and 50% into defensive assets. In the growth assets portion, you own 50 units of a global equity fund priced at £100 per unit. Growth assets fall by 40%. Let’s assume your defensive assets are unchanged in value. You still own 50 global equity fund units, but they are now priced at £60. Your growth-defensive split has moved from 50/50 to 37.5/62.5. Time to rebalance.

Figure 1: Market falls leave you underweight growth assets

Source: Albion Strategic Consulting

Rebalancing i.e. buying equities to realign the portfolio with its allocation target, helps to ensure a quicker recovery back to where you started. This is because the breakeven price of your equity holdings is now lower.

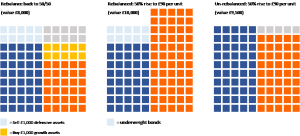

So, let’s now assume that you rebalance by taking £1,000 from your defensive assets and buying growth assets to get you back to a 50/50 split (left hand grid below). You can buy 16.7 units at £60 with the £1,000 raised. To get your portfolio back to its starting value of £10,000 your now 66.7 global equity units need to rise 50% to £90 per unit (middle grid). However, an un-rebalanced portfolio (right hand grid) only rises to £9,500 with this 50% rise. In fact, to get back to a portfolio value of £10,000 and un-rebalanced portfolio requires a rise of 67% in the global equity units to £100.

Figure 2: Rebalancing helps the portfolio to recover faster

Source: Albion Strategic Consulting

Even if the markets fall again after rebalancing, the opportunity exists to rebalance again, likewise further reducing the rate of return required to get back to where you were compared to un-rebalanced portfolios. That takes courage and discipline, when your emotions are telling you to do the opposite.

The issue of a potential rebalance on the back of large market falls is certainly being considered and don’t be surprised if we raise this with you. You now know why. Remember, if you are drawing an income from your portfolio, withdrawing from bonds can get you closer to your target. Likewise, if you have incoming cashflows, this too can be used to buy growth assets.

As David Swensen, CIO of Yale University’s Endowment and one of the world’s most highly respected institutional investors states[1]:

‘The fundamental purpose of rebalancing lies in controlling risk, not enhancing returns. Rebalancing trades keep portfolios at long-term policy targets by reversing deviations resulting from asset class performance differentials. Disciplined rebalancing activity requires a strong stomach and serious staying power.’

Do you really need to rebalance? The answer for most investors is likely to be ‘yes’ when the time comes. If we feel a rebalance is necessary, we will be in touch to discuss this with you.

As ever, please feel free to give us a call if you have any questions.

Risk Warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

Errors and omissions excepted.

[1] Swensen, D., (2000) Pioneering Portfolio Management. New York: The Free Press

Recent Comments