Inflation measures the general increase in the price of goods and services. Left unchecked, it can be a dangerous foe to the long-term investor, eroding the purchasing power of one’s hard-earned cash over time. Since the COVID-19 pandemic began, inflation numbers have frequented the headlines. Financial stimulus around the globe has meant that more money circulating in the economy is chasing a similar (or fewer) number of goods and services, resulting in price increases.

The table below shows the latest annual inflation figures from around the globe, measured using the consumer price indexes (CPI)[1]. Most countries have not seen numbers this high since the early 90’s[2]. Using the rule of 72, one can get a sense of how quickly purchasing power halves at these higher-than-average rates[3].

Table 1: Annual inflation rates by region (2021)

| Country | UK | US | Eurozone | Spain | Japan |

| 2021 Inflation rate | 5.4% | 7.0% | 5.0% | 6.5% | 0.6% |

| Years to half wealth | 13 | 10 | 14 | 11 | 120 |

Source: Koyfin © All rights reserved. Inflation measured using Consumer Price Index of each country.

Contrary to its negative implications, the consensus of economists has shifted over the years, the modern position being that a small amount of annual inflation is, in fact, desirable[4]. The Bank of England, for example, targets an annual inflation rate of 2%[5]. Primarily, this is to avoid an alternative scenario where prices are falling each year and consumers are encouraged not to spend at all, but to wait until prices fall further. The danger with a deflationary environment is that it is very hard cycle to get out of, price falls tend to lead to further price falls – just ask Japan!

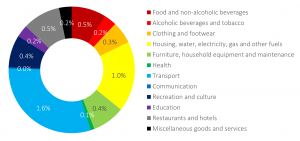

Although the inflation rate is generally thought of as a single number, the consumer price index in the UK is measured using around 180,000 different prices across 720 different goods and services each month[6]. What is more, the ‘shopping basket’ is weighted using estimates of the average UK consumer, which is updated each year depending on spending patterns. This is a valid criticism of CPI indexes, as they do not account for substitutions of expensive products for less expensive ones[7]. The chart below shows a breakdown of the December 2021 inflation figure and the contribution of each basket of goods or services to the overall number. Around half of the 5.4% came from increases in transport and energy prices, whereas healthcare and communication services had negligible impact.

Figure 1: UK inflation contribution by division (2021)

Data source: ONS (2022)

The reality of the chart above is that, whilst it provides a reasonable estimate for the average consumer, everyone is subject to their own unique inflation rate. For example, individuals living in older houses that are poorly insulated are likely to be feeling the effects of higher energy costs more than those living in new-builds with modern insulation and renewable energy sources. Similarly, those that are frequent flyers (not that there are many people in this bracket at present!) have experienced hefty price hikes, whereas other transport services were far less impacted.

Table 2: UK price increase by transport type (2021)

| Transport | Railway | Road | Air | Sea |

| Annual increase | 4% | 3% | 29% | 0% |

Data source: ONS (2022)

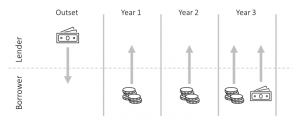

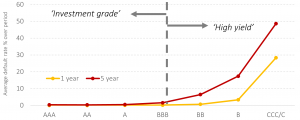

Despite inflation being more nuanced than just the headline figure, it is true that a general rise in prices can be uncomfortable for investors, reducing the ‘real’ (after inflation) returns earned over a given period. That being said, the systematic investment philosophy adopted in your portfolio was built to weather such storms. Equity markets offer the opportunity to participate in the future earnings of global corporations, whose prospects rely on the goods and services they provide. Exposure to smaller and value companies – those that appear cheap relative to a fundamental measure such as book-value – offer the opportunity of diversification and higher expected returns.

Whilst no perfect inflation hedge exists – gold and commodities, for example, are no silver bullet – it is sensible to expect a well-diversified, low-cost portfolio consisting of equities and high-quality bonds to deliver above inflation returns over the medium to long term (in other words 10-years or more).

If you have any questions, thoughts or actions relating to the content of this article please get in touch with us by calling us on 028 9099 6948 or by emailing info@pacem-advisory.com

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

[1] CPI is a widely accepted inflation measure in most developed economies.

[2] ONS (2022) UK CPI. March 1992 – 7.1%, December 2021 – 5.4%.

[3] For example: 72 ÷ 5.4 ≈ 13-years to half purchasing power (i.e., £1 of goods now costs £2 in the future).

[4] Marketplace (2019) Why is inflation necessary? https://www.marketplace.org/

[5] Bank of England (2022) Inflation and the 2% target. https://www.bankofengland.co.uk/

[6] ONS (2020) Consumer price inflation basket of goods and services: 2020

[7] Rational Reminder (2021) Episode 178: Are inflation concerns inflated?

Recent Comments