It feels at the moment that the markets have gone a little mad. Almost everything you hear on the news or read about investing suggests that everything is going up. The US market is up by around 44% in the past year[1] in dollar terms, Tesla’s share price has risen by 124% over the same period, and Lucid Motors, who have just started production on its electric car in Q3, for which it has (a mere) 13,000 orders, floated on the NYSE and already has a market capitalisation greater than that of Ford, after its share price doubled in a month!

In the US, call options on individual company shares, which provide investors the right to buy a stock at given date in the future at a predetermined price in return for a premium payment, currently exceed the value of actual shares traded by value by almost a half. Options are a way of leveraging exposure to a stock without having to come up with the face value of buying the stock directly. They are a sure sign of speculation, not least by retail investors.

There is no doubt that when markets become frothy, investors are prone to a fear of missing out (FOMO) that makes them wish that they were invested in something that has done well (mostly identified with hindsight) and tempting some to lose discipline and plunge in, hoping that the magic (luck) will continue. When things do not go as hoped, there is a temptation to cut losses and run.

Let’s take a quick look at the ARK Innovation ETF that has hit the investment news headlines as one of the best performing funds in 2020, gaining over 150% in US$ terms, and more importantly how investors in the fund have fared. It is a very concentrated portfolio of technology and healthcare innovators. It holds more than 10% in Tesla and the top 10 of 45 or so stocks make up more than 50% of the portfolio. The firm also owns more than 10% of the shares of a number of portfolio stocks, which raises liquidity risks (remember Woodford?).

In the case of ARK Innovation, it had a stellar run from April 2020, out of the bottom of the Covid-induced sell-off until December 2020 but has struggled since then, falling almost 35% at one point in the first few months of 2021.

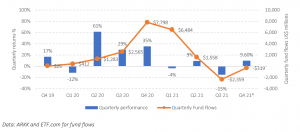

Figure 1: Fund flows often follow performance

It is worth noting that the fund had inflows of just US$25 million in Q4 2019 but these peaked at almost US$ 7.8 billion in Q4 2020. You do not have to be a mathematician to work out that the investor money that went into the fund at the back end of 2020 will have not captured the bulk of the positive returns of 2020 and suffered the subsequent downswing. A rough calculation using monthly performance and fund flow data suggests that from the start October 2019 to the end of October 2021 the fund delivered an annualized return of 66% p.a., whereas the average investor return was around 25% p.a. i.e. a 40% p.a. difference.[1] Over this same period a well-known US index fund delivered 26% p.a.!1

ARK Innovation relies on manager skill (or luck) in picking a mere 45 or so companies out of the many thousands of companies around the world. The risks are very high. The fund management world is littered with the corpses of such ‘stellar’ funds. In the UK for example, over the past twenty years or so, around half of all investment trusts launched have failed to survive[2] in their original form.

It is hard not to suffer FOMO at times like these, but it is worth remembering that investing is a not a sprint but a marathon. When markets rise substantially, as they have done recently, regular rebalancing results in the sale of assets that have performed well and banks the excess proceeds. Seemingly irrational markets can persist for a long time and as the old saying goes, no-one rings the bell at the top of the market. Stay invested, remain diversified and be thankful that your financial well-being does not lie in the hands of any one fund manager owning just 45 stocks. Remember that it is the tortoise who wins the race.

Risk warnings

This article is distributed for educational purposes and should not be considered investment advice or an offer of any security for sale. This article contains the opinions of the author but not necessarily the Firm and does not represent a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable but is not guaranteed.

Past performance is not indicative of future results and no representation is made that the stated results will be replicated.

[1] Albion Strategic Consulting used an XIRR calculation with monthly fund size, flows and performance data and assuming fund flow occurred at the start of the month. It provides a rough estimate and order of magnitude insight. Daily data unavailable.

[2] Numis, as quoted in: Investors Chronicle. Surviving the investment trust shake-up August 6, 2020, By Dave Baxter

[1] Vanguard Total Stock Market Index Fund in US$ Admiral share class www.vanguard.com